The MTBPS makes a start: now we need the policies for growth

The National Treasury did a sterling job in producing a Medium-Term Budget Policy Statement that committed to fiscal consolidation while highlighting the need for policies to achieve long-term sustainable growth. Revenue collection was R120.3 billion higher than expected, largely because of the windfall from higher commodity prices. This helped reduce the immediate fiscal pressures, while continuing to stabilise public finance. Despite this improvement, revenue collection is still below pre-pandemic revenue estimates.

There has been much debate on government’s commitment to fiscal consolidation, with some confusing it with stringent austerity measures. This is because the term austerity gained prominence in economic journals from 1990 and with every economic crisis since then, recovery measures have often been criticised as austerity without a distinct measurable definition of the term. Austerity measures are typically strict economic policies implemented when a country is at risk of defaulting. It is characterised by the privatisation of social programmes, public sector retrenchment, considerable decrease in social expenditure, and regressive tax reforms. The South African government is yet to implement such stringent measures in its attempt to shrink the budget deficit.

Fiscal consolidation is required for the achievement of sustainable economic growth. A study by the World Bank[1] shows that higher debt can significantly damage a country’s long-run growth prospects. According to the study, for each percentage point over 64% of debt-to-GDP, there’s an annual real growth contraction of about 0.02 percentage points. Fiscal consolidation is an adjustment to the fiscus where spending cuts are made to improve fiscal positions. These adjustments should preserve spending on critical infrastructure as well as social spending to prevent strains on growth and maintain social safety nets to protect low-income households.

Contrary to what some assume, the national budget is highly redistributive. The social wage, which includes public expenditure on health, education, housing, social protection, transport, employment programmes and local amenities totals about R1 trillion. This translates to almost 60% of consolidated non-interest spending per year over the next three years. In fact, when compared with many emerging-market peers, South Africa’s budget is the most redistributive. Alarmingly, 27,8 million South Africans are recipients of social grants. That is 46% of the population. Spending on the social wage has grown from R860 billion in 2018/19 financial year to R1.1 trillion in 2021/22.

The pandemic has indeed left many people vulnerable, and the high unemployment rate is an indication of the precarious position of many businesses, particularly small and medium-sized businesses. The National Treasury will have to provide short-term social support, but the call to extend this support perpetually is something the country can ill afford. Besides, it’s merely plastering over the problem instead of tackling it head-on. This is likely why Finance Minister Enoch Godongwana spent a significant portion of his speech talking about the necessary reforms required to help the country achieve long-term sustainable growth. A few years ago, the National Treasury published a document that looked at how reforming network industries, such as the energy, telecommunications, and transport sectors, can help the country achieve sustainable growth and increase employment. But like many other reform documents before it, implementation has been poor. It is not the National Treasury’s role to ensure that road and rail infrastructure is maintained and extended or that social infrastructure such as hospitals and schools are fit for purpose. Treasury is not responsible for building houses and making sure that water and sanitation are adequately maintained and delivered to South Africans. Nor is it responsible for the hiring of competent and ethical people in government to deliver services that will help South Africans lead better lives. This is the role of other government departments and it is the President’s responsibility to crack the whip.

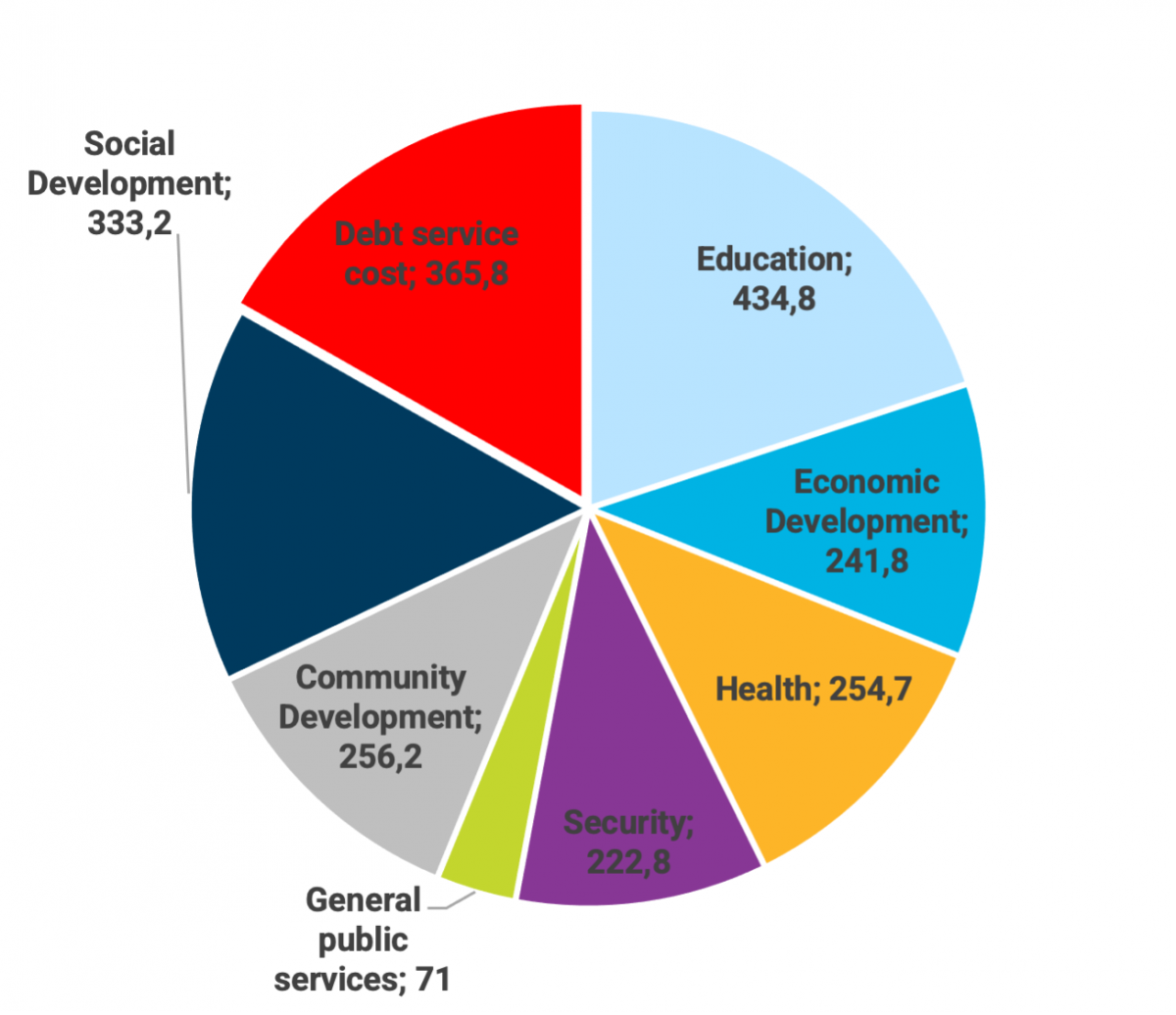

The South African government made a commitment to shrink the growing deficit in 2012, when it put in place a spending ceiling. However, the ceiling has been breached numerous times, compromising the fiscal framework. Countries that postpone fiscal adjustments typically end up paying a much higher price when economic necessity forces them to act. This is true of South Africa currently. Had South Africa built more fiscal space (lower debt), the response to the Covid-19 pandemic would be a lot more supportive to the poor and vulnerable, cushioning the damage to the economy caused by the pandemic. Furthermore, part of the reason for South Africa’s sovereign rating downgrades is because of the country’s burgeoning debt. This is in turn has increased the country’s risk premia, as investors demand more compensation for the risk they take in holding South African bonds. This is also the reason why the interest on debt is one of the highest in the world. Government currently spends more on servicing debt than it spends on health and police services; and in the financial year 2024/25, debt-service costs will be the second largest expenditure item after education (see Figure 1). Currently, on average, for every rand collected in revenue each year, 21 cents goes toward paying the interest on public debt. To say this is absurd would be an understatement. South Africa pays three times more as a share of GDP than Greece paid in interest at the height of the global financial crisis and that is why Greece was forced to adopt austerity measures.

Figure 1: Medium-term estimates FY24/25

The argument that debt is not a problem and that there is room to incur more in order to grow the economy is nonsensical. South Africa’s GDP in the past 10 years has averaged around 1%. During that period, public debt roughly trebled from 25% of GDP to about 75% of GDP. South Africa experienced slower economic growth, incurred more debt, increased its unemployment rate, and became more unequal. During the period prior (from 2000 to 2010), GDP growth averaged 4%, public debt fell from about 60% to just above 20%, and deficits averaged less than 2% of GDP. During this period, the poverty rate as measured by Stats SA fell from about 48% to about 36% and unemployment fell from about 30% to about 22%. The social safety net was expanded with the rollout of child support grants, no-fee schools, free basic municipal services for the poor, and an expansion of unemployment insurance to cover domestic and farm workers. A longer commodity boom and stronger global growth were special features that are absent today. But notwithstanding, South Africa’s economy was in better shape than it is today.

South Africa should adopt expansionary fiscal contraction. This is a policy to reduce both the fiscal deficit and high levels of indebtedness, which in turn will lead to market confidence and create expectations among the public about future income. This will also result in favourable growth effects.

The quality of fiscal reforms, the speed with which they are adopted, and the conviction that they will be carried out are fundamental in convincing businesses and households that economic conditions have improved and that they can adjust their consumption and investment plans accordingly. The effects on confidence are visible in the favourable responses of stock market and real estate prices to fiscal contractions that increase private wealth, reduce precautionary savings, and lead to an increase in private consumption and investment.

Taking into account the National Treasury’s GDP forecasts, GDP growth between 2014 and 2024 will average just 0.9 percent. Incurring more debt when growth is so weak will only put South Africa in a fiscal crisis.

[1] Sovereign Debt and the Financial Crisis: Will This Time Be Different? (worldbank.org)

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.